Please Note: If you have purchased a vessel that is titled in a state other than Florida, please contact our office at 941.861.8300, option 2 for instructions.

Florida Title Transfer

When a vessel is already titled in Florida, the title must be released by the seller(s) to the purchasers. The following is required to apply for a Florida Title and a packet has been designed to help process your transfer of a Florida Title by mail. For requirements and fees, download the Vessel Title Packet.

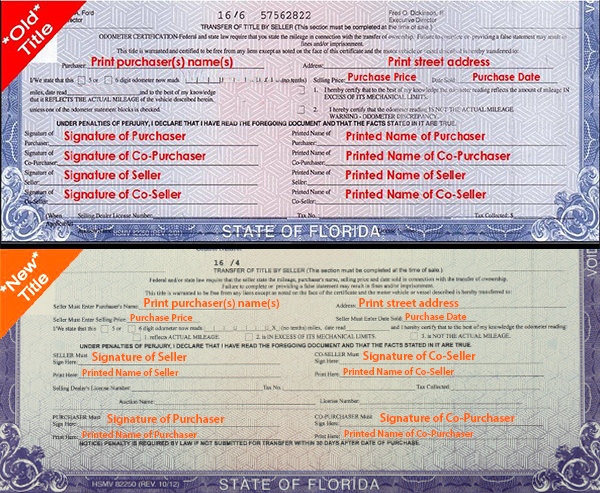

- Florida Title - The transfer of title by seller section must be completed with:

- Purchaser’s name and address

- Date of sale

- Selling price

- Signature and printed name of seller(s). If there are two sellers and their names are joined by “and” on the title, both sellers must sign. If names are joined by "or", only one seller is required to sign.

- Signature and printed name of purchaser(s). Anyone listed as an owner must sign and print their name.

- If appointed power of attorney (POA), the original POA document must be presented at the time of application.

- Application for Certificate of Title with/without Registration - form FLHSMV 82040 must be completed and signed by the purchaser(s) if both owners are not present.

- A Bill of Sale - suggested and may be required. If you purchase a boat and motor (excluding an inboard motor) and have an itemized bill of sale from the seller that lists the cost of each item separately, sales tax will be calculated only on the purchase price of the boat.

- Registration Fees - Fees are determined by vessel length, and applicant’s birth month.

- Sales Tax - 6% sales tax will be collected on the purchase price. If the vessel is registered to a Sarasota County address the first $5,000.00 of the purchase price is subject to an additional 1% discretionary sales surtax. If the vessel will be registered in another Florida county, discretionary sales tax rates may differ.

- Proof of Identification - May be a valid driver's license or state issued identification card, from any state, or passport.

- If recording a lien, the lien holder's name, address, FEI and date of lien are required.

- If the title will be issued in the name of a trust, copies of the official trust must be presented. If the title will be issued in a business name then proof that the business is registered in Florida and the FEI number will be required.

- NOTE: Cross-outs, white-out, alterations, or erasures may void the title and may require you to submit a Notarized or Perjury Clause Bill of Sale signed by the seller.

For assistance, please contact our office at 941.861.8300, option 2.

Renew Registration

Renew Registration